Introduction

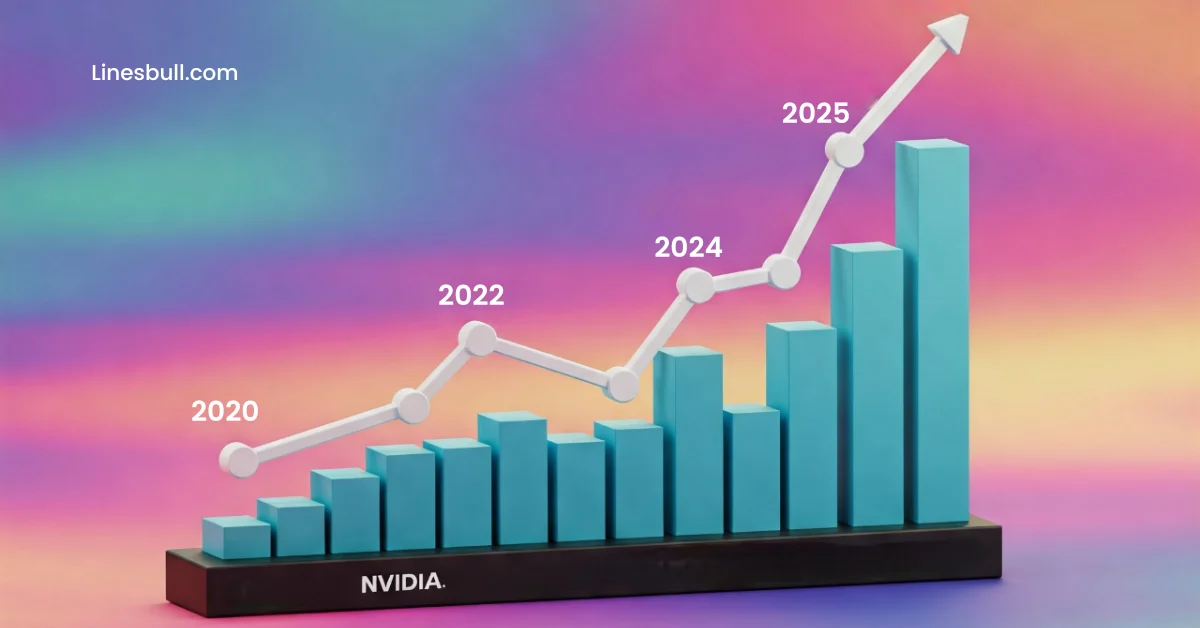

NVIDIA Stock Price Evolution, founded in 1993, has grown into a global leader in graphics processing units (GPUs), artificial intelligence (AI), and data center technologies. Known for its innovations in gaming, professional visualization, AI, and cloud computing, NVIDIA has been a major force in the stock market.

Over the years, NVIDIA’s stock has seen significant highs and lows, driven by technological advancements, financial performance, and external market factors. This article explores NVIDIA’s stock history, major milestones, and its current market standing.

The Founding and Early Days of NVIDIA

NVIDIA was founded in April 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, with the vision of revolutionizing computing through graphics processing.

Key Milestones in NVIDIA’s Early Years

| Year | Milestone | Impact on Company |

|---|---|---|

| 1993 | Founded in Santa Clara, California | Started as a graphics-focused company |

| 1995 | Launched NV1, first GPU | Gained recognition but faced challenges |

| 1999 | Launched GeForce 256 | Defined the modern GPU era |

During this period, NVIDIA established itself as a leader in gaming hardware, competing with major players like Intel and AMD.

Read Also:

Technical and Fundamental Analysis

NVIDIA’s Stock Market Debut (1999 IPO)

NVIDIA went public on January 22, 1999, offering its shares at $12 per share (adjusted for stock splits). The IPO raised approximately $42 million, providing the company with the capital needed for expansion.

Initially, the stock showed steady growth, benefiting from the increasing demand for GPUs in gaming. Over time, NVIDIA’s stock experienced volatility, largely influenced by product launches and industry trends.

The Early 2000s: Establishing a Market Presence

In the early 2000s, NVIDIA expanded aggressively, focusing on GPU technology for gaming and professional applications. Key developments during this time included:

- 2000: Launched GeForce2, which saw widespread adoption in gaming.

- 2002: Introduced the first GPU for mobile devices, extending its market reach.

- 2006: Revolutionized parallel computing with the launch of CUDA, enabling GPUs to handle AI and deep learning tasks.

These advancements contributed to steady growth in NVIDIA’s stock price, though competition from AMD and Intel kept the market challenging.

The 2010s: Rise of AI and Data Center

The 2010s marked a turning point for NVIDIA as it shifted beyond gaming into artificial intelligence, deep learning, and cloud computing.

Major Stock Growth Drivers in the 2010s

| Year | Event | Impact on Stock |

|---|---|---|

| 2012 | Released Kepler GPUs | Increased gaming and enterprise demand |

| 2016 | Launched Pascal GPUs | Stock price surged due to AI applications |

| 2018 | Entered AI and self-driving car market | Expanded revenue streams |

By 2018, NVIDIA was at the forefront of AI computing, with its GPUs powering everything from self-driving cars to data centers. The stock reflected this growth, reaching record highs.

The Cryptocurrency Boom and Its Impact on NVIDIA’s Stock

During the cryptocurrency mining boom (2017-2018), NVIDIA’s GPUs became highly sought after, driving sales and pushing stock prices higher. However, as crypto markets crashed in late 2018, NVIDIA faced a decline in GPU demand, causing stock prices to drop.

Despite this setback, NVIDIA recovered by focusing on AI, gaming, and cloud computing, ensuring long-term growth.

COVID-19 Pandemic and Market Fluctuations

In early 2020, the stock market faced massive volatility due to the COVID-19 pandemic. NVIDIA’s stock initially declined but quickly rebounded due to:

- Increased demand for gaming GPUs as people stayed home.

- Growth in AI and cloud computing as businesses moved online.

- Expansion into data centers with high-performance AI chips.

By the end of 2020, NVIDIA’s stock had reached record highs, making it one of the best-performing tech stocks of the year.

The 2020s: Dominating AI, Cloud Computing, and Metaverse

NVIDIA continues to innovate in AI, cloud computing, and the metaverse, maintaining its dominance in the tech industry. The company’s acquisitions, including the failed Arm Holdings deal, indicate its ambition to expand further.

Key areas of growth include:

- AI-powered data centers

- Self-driving vehicle technology

- Gaming and virtual reality (VR) applications

NVIDIA’s stock remains strong, reflecting confidence in its long-term vision.

Stock Splits and Their Impact on Investors

NVIDIA has split its stock five times to make shares more accessible to investors.

History of NVIDIA Stock Splits

| Date | Split Ratio | Price Before Split |

|---|---|---|

| 2000 | 2-for-1 | $100 per share |

| 2001 | 2-for-1 | $80 per share |

| 2006 | 2-for-1 | $120 per share |

| 2007 | 3-for-2 | $36 per share |

| 2021 | 4-for-1 | $750 per share |

Stock splits have made NVIDIA shares more affordable, attracting new investors.

Financial Performance and Earnings Report

NVIDIA’s financial performance has been a key driver of stock growth.

Recent Earnings Highlights

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue | $26.9B | $29.5B | $35B+ |

| Net Profit | $9.8B | $10.5B | $12B+ |

| Stock Price Growth | +125% | +80% | Expected Growth |

NVIDIA continues to report strong earnings, reinforcing its position as a stock market leader.

NVIDIA vs. Competitors: A Stock Market Comparison

NVIDIA competes with AMD and Intel in various sectors.

| Company | Market Cap (2023) | Stock Performance (5-Year Growth) |

|---|---|---|

| NVIDIA | $1.2 Trillion | +800% |

| AMD | $200 Billion | +500% |

| Intel | $150 Billion | +50% |

NVIDIA’s growth outpaces competitors, making it a top tech stock.

Key Factors Affecting NVIDIA’s Stock Price

- Product Innovation – AI and gaming advancements boost demand.

- Market Trends – Cryptocurrency, cloud computing, and metaverse play a role.

- Competition – AMD and Intel’s moves impact NVIDIA’s stock.

- Economic Conditions – Inflation, interest rates, and market downturns affect prices.

NVIDIA’s Role in the AI Revolution

NVIDIA is leading AI development with:

- Data center GPUs for AI computing

- Partnerships with Tesla for autonomous driving

- AI-powered cloud services

This focus on AI ensures long-term stock growth potential.

Future Predictions: Where is NVIDIA Stock Headed

Analysts predict continued growth due to:

- Expansion in AI and self-driving cars

- Strong gaming and cloud computing revenue

- Potential new acquisitions and partnerships

Long-term investors may find NVIDIA a solid choice for future growth.

Conclusion

NVIDIA’s stock has experienced tremendous growth, fueled by AI, gaming, and cloud computing. While market fluctuations remain, NVIDIA’s strong innovation pipeline makes it a valuable long-term investment.

1 thought on “NVIDIA Stock Price Evolution – Biggest Gains, Performance & What’s Next!””